When you buy generic medications from an online pharmacy, your insurance might cover it - or it might not. It depends on which online pharmacy you use, what your insurance plan allows, and how the prescription is processed. Many people assume all online pharmacies work like CVS or Walgreens when it comes to insurance. They don’t. And that confusion can cost you money - or worse, leave you without medication.

Not All Online Pharmacies Are the Same

There are two main types of online pharmacies when it comes to insurance: mail-order pharmacies tied to your insurance plan, and independent online pharmacies that sell drugs like any other e-commerce site. Mail-order pharmacies are part of your health plan’s pharmacy benefit manager (PBM) network. Think Express Scripts, CVS Caremark, or Optum Rx. These services are built into your insurance. When you get a 90-day prescription from your doctor, you can choose to have it filled through one of these services. They usually charge a lower copay - often $5 for a 30-day supply or $10 for 90 days - because they’re in-network. Independent online pharmacies, like Amazon Pharmacy or Honeybee Health, operate separately. They may accept insurance, but only if they’re in your plan’s network. Many don’t. If you order from one that doesn’t accept your insurance, you pay full price upfront and then try to get reimbursed - a messy, time-consuming process that often fails.How Insurance Actually Covers Generics

Your insurance doesn’t cover drugs randomly. It uses a formulary - a list of approved medications - divided into tiers. Generics almost always sit in Tier 1, the cheapest level. Here’s how it breaks down:- Tier 1 (Generics): $5-$10 copay for 30-90 days. This is where most online mail-order services shine.

- Tier 2 (Preferred Brands): 30% coinsurance, capped at $200 per prescription.

- Tier 3 (Non-Preferred Brands): 50% coinsurance, capped at $200.

- Specialty Drugs: 15% coinsurance (retail) or up to $425 cap (mail-order).

Mail-Order vs. Retail: The Real Cost Difference

Many people think buying generics at Walmart or Costco is cheaper than using their insurance’s mail-order service. Sometimes it is. Walmart offers dozens of common generics for $10 for a 90-day supply - no insurance needed. If you have a high-deductible plan, that $10 might be cheaper than your $15 copay at a local pharmacy. But here’s the catch: mail-order through your insurer usually costs even less. For example:| Method | Supply | Typical Cost | Delivery Time |

|---|---|---|---|

| Mail-order (in-network) | 90-day | $10 | 5-7 business days |

| Walmart (cash price) | 90-day | $10 | Immediate |

| Local pharmacy (insurance copay) | 30-day | $15 | Immediate |

| Amazon RxPass | Unlimited generics | $5/month | 1-3 days |

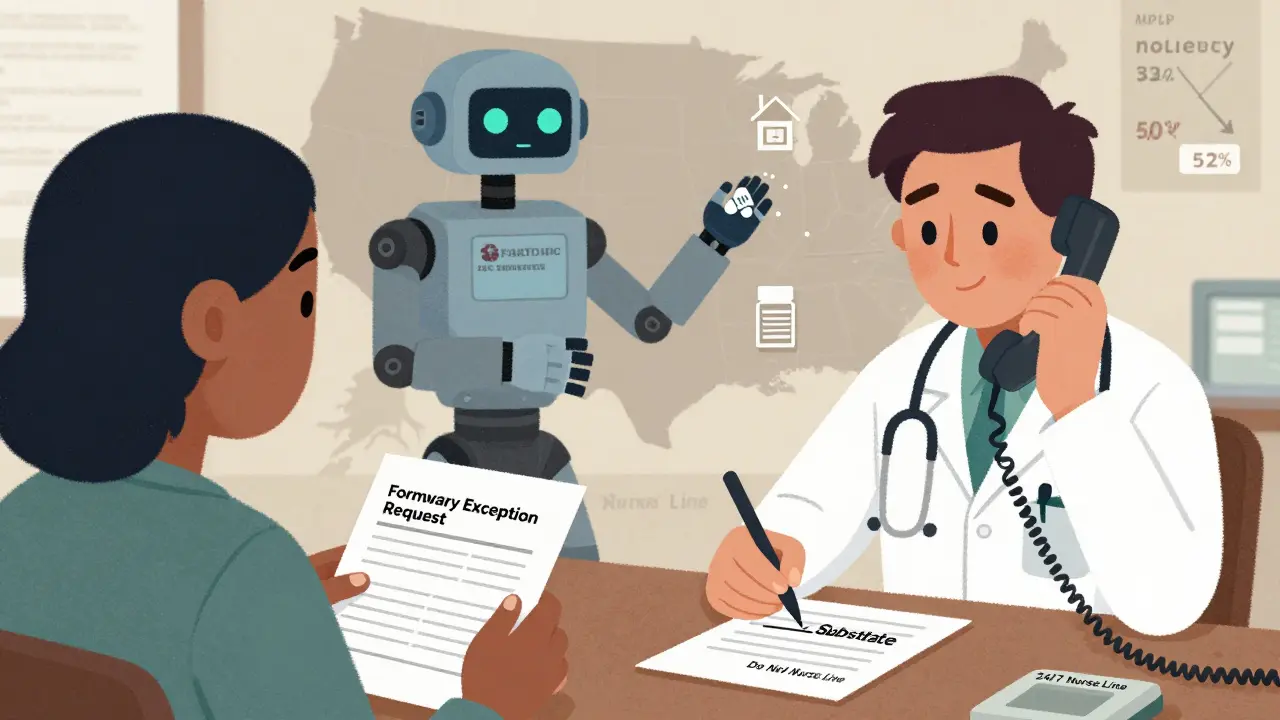

Non-Medical Switching: When Insurance Overrides Your Doctor

You might wake up one day to find your brand-name medication replaced with a generic - without your doctor’s approval. This is called non-medical switching, and it’s becoming more common. Insurers do this to cut costs. A 2023 report from the Kaiser Family Foundation showed 68% of large employers now require generic substitution when available. That’s not necessarily bad - generics are safe and effective. But sometimes, the switch causes problems. One patient on PatientAdvocate.org reported severe side effects after being switched from Copaxone to a generic MS drug without warning. She ended up in the ER. If your doctor believes a brand-name drug is necessary, they can file a formulary exception or prior authorization. This is a formal request to your insurer to cover the non-preferred drug. You’ll need documentation - usually a letter from your doctor explaining why the generic won’t work for you.How to Check Coverage Before You Order

Don’t guess. Don’t assume. Always verify. Here’s how:- Find your insurer’s formulary tool. Most have one. Aetna’s medicine search lets you type the first three letters of a drug name. CVS Caremark has a "Check Drug Cost & Coverage" page.

- Enter your medication. Look for the tier and copay amount. If it says "Mail-Order Available," you can save money by choosing that option.

- Check if your chosen online pharmacy is in-network. If you’re using Amazon Pharmacy, go to their website and enter your insurance info. If it says "Not Covered," you’re paying out-of-pocket.

- Call your insurer’s pharmacy help line. MHBP offers a free 24/7 nurse line at 1-800-556-1555. They can tell you exactly what your plan covers and how.

What Happens If You Use an Out-of-Network Pharmacy?

If you order from a pharmacy that’s not in your plan’s network - say, a random website you found on Google - your insurance won’t pay. Period. You’ll pay full price. Then you can try to file a claim for reimbursement. But most insurers won’t reimburse you unless the drug is medically necessary and you have documentation proving you couldn’t get it elsewhere. Even then, approval rates are low. And here’s the risk: Some out-of-network online pharmacies sell counterfeit or substandard drugs. The FDA has issued warnings about fake insulin, blood pressure meds, and even erectile dysfunction pills sold through unregulated sites. Always stick to pharmacies that are licensed and verified - look for the VIPPS seal (Verified Internet Pharmacy Practice Sites).The Big Picture: Why This Matters in 2025

By 2025, nearly half of all generic maintenance medications will be delivered to your home - up from 32% in 2022. Insurers are pushing this shift hard. Why? Because it’s cheaper, more convenient, and reduces missed doses. But it’s not perfect. The system is designed to save money - not necessarily to make care easier. You’re expected to navigate formularies, copays, network rules, and delivery delays. And if you’re on multiple medications, keeping track of which one is covered where becomes a full-time job. That’s why tools like RxPass and Walmart’s $10 program are gaining traction. They cut through the complexity. You don’t need to understand PBMs or tiers. You just pay a flat fee and get what you need. The future of generic drug access isn’t just about insurance. It’s about choice. And right now, you have more options than ever - if you know where to look.What to Do Next

If you take generic medications regularly, here’s your action plan:- Log into your insurance portal and check your formulary for every drug you take.

- Compare your current copay with Walmart’s cash price and Amazon RxPass (if you’re a Prime member).

- If your insurer switched your medication without warning, call them. Ask why. Request your original drug if you had side effects.

- Ask your doctor to write "Do Not Substitute" only if you’ve had a bad reaction to a generic. Don’t do it just because you prefer the brand.

- Use a 24/7 nurse line if you’re confused. It’s free, and they’re trained to explain this stuff.

Do all online pharmacies accept my insurance?

No. Only pharmacies in your insurance plan’s network accept coverage. Mail-order services tied to your PBM (like Express Scripts) do. Independent online pharmacies like Amazon or random websites may not. Always check the pharmacy’s website or call your insurer before ordering.

Is it cheaper to use insurance or pay cash for generics?

It depends. If you have a high-deductible plan, paying cash at Walmart ($10 for 90 days) is often cheaper than your copay. If you’re on a low-deductible plan with a $5 generic copay, insurance wins. Always compare the cash price with your insurance copay before deciding.

Can my insurance force me to switch from a brand-name drug to a generic?

Yes. This is called non-medical switching. Insurers do it to save money. But if the switch causes side effects or doesn’t work, your doctor can request a formulary exception. You’ll need documentation, but insurers must review it.

What is Amazon RxPass, and should I use it?

Amazon RxPass is a $5/month subscription for Prime members that gives unlimited access to over 100 common generics. It’s great if you take medications like lisinopril, metformin, or atorvastatin. But if your meds aren’t on the list, you’ll still need insurance or pay full price. It’s not a replacement for insurance - it’s an alternative.

Are online pharmacies safe?

Only if they’re licensed. Stick to pharmacies with the VIPPS seal (Verified Internet Pharmacy Practice Sites). Avoid sites that don’t require a prescription, offer drugs at suspiciously low prices, or are based overseas. The FDA has warned about fake drugs sold through unregulated sites.

What should I do if my insurance denies coverage for a generic?

First, confirm the drug is on your plan’s formulary. If it is and you’re still denied, call your insurer’s pharmacy help line. Ask for a formal appeal. Your doctor can submit a letter explaining medical necessity. Most denials are overturned with proper documentation.

Melissa Taylor, December 15, 2025

Just switched my lisinopril to mail-order through my PBM and saved $12 a month. No more driving to the pharmacy, no copay surprises. If you’re on maintenance meds, this is low-hanging fruit.

Christina Bischof, December 16, 2025

Amazon RxPass is a lifesaver if you’re on a few common generics. I get metformin, atorvastatin, and levothyroxine for $5 a month. No insurance hassle. Just wish they had more drugs on the list.

Raj Kumar, December 17, 2025

in india we dont even have this mess. generics are $1 and sold at every corner shop. no formularies, no pBM bs. just buy and go. why does america make simple things so complicated?

John Brown, December 18, 2025

Biggest thing people miss: if your doctor didn’t write "Do Not Substitute," your insurer can swap your med anytime. I got switched from a brand-name antidepressant to a generic and felt like crap for weeks. Took three calls and a letter from my doc to get it reversed. Don’t assume it’s fine.

RONALD Randolph, December 18, 2025

THIS IS WHY AMERICA IS BROKE. Insurers are letting some random website in India sell you fake pills and then act surprised when people die. The FDA should shut down every unverified pharmacy and jail the CEOs. This isn't healthcare-it's a scam.

Cassie Henriques, December 20, 2025

Just checked my formulary-my insulin isn’t covered by mail-order? But it’s Tier 1? Why? The PBM website says "specialty drug" but it’s not even a biologic. So much for transparency. Calling my insurer tomorrow.

Lisa Davies, December 21, 2025

Walmart’s $10 generics are my new best friend. I’m on a high-deductible plan and paying cash saves me $20 a month. No need to wait 5 days for shipping. Just grab it on your lunch break. Simple. Fast. No forms.

Michelle M, December 22, 2025

It’s funny how we treat medicine like a subscription service now. RxPass, mail-order, cash prices-it’s all just different ways to pay for the same thing. But we’ve lost the human part. The doctor-patient trust. The idea that your health shouldn’t be a spreadsheet. We’re optimizing for cost, not care.

John Samuel, December 23, 2025

Let’s be real-PBMs are the real villains here. They’re middlemen who don’t prescribe, don’t dispense, and don’t care if you live or die. They just move money around and call it "cost containment." Meanwhile, you’re stuck choosing between your meds and your rent. This system is morally bankrupt.

Nupur Vimal, December 25, 2025

you think this is bad wait till you try getting a prescription filled in rural america no internet no car no insurance just you and your 80 year old grandma trying to figure out if amazon rxpass works with your medicaid

Jake Sinatra, December 27, 2025

Always verify. Always. I once ordered from a site that looked legit-had SSL, good reviews, even a phone number. Turned out it was a phishing site. My credit card was drained and I got fake blood pressure pills. Never again. Stick to VIPPS.

Jocelyn Lachapelle, December 27, 2025

My mom got switched from her brand-name thyroid med without warning. She had heart palpitations for two weeks. We called the insurer, they said "it’s the same thing." But it wasn’t. The generic didn’t work for her. Now we have a letter from her endocrinologist on file. Don’t let them push you around.

Mike Nordby, December 28, 2025

According to the 2023 MHBP analysis cited in the post, generic substitution saved members $42 per prescription on average. However, the statistical significance of this data is questionable without access to the full methodology, sample size, or control variables. Additionally, the formulary tier structure described lacks citation to the specific insurance plan’s documentation, which may vary by region and employer. Transparency in PBM contracts remains a critical gap in public policy.

John Brown, December 30, 2025

That’s why I always check the cash price first. If Walmart’s cheaper than my copay, I pay cash. No paperwork, no waiting. My insurer doesn’t even know I’m buying it. And honestly? I don’t care if they do. I’m not playing their game.