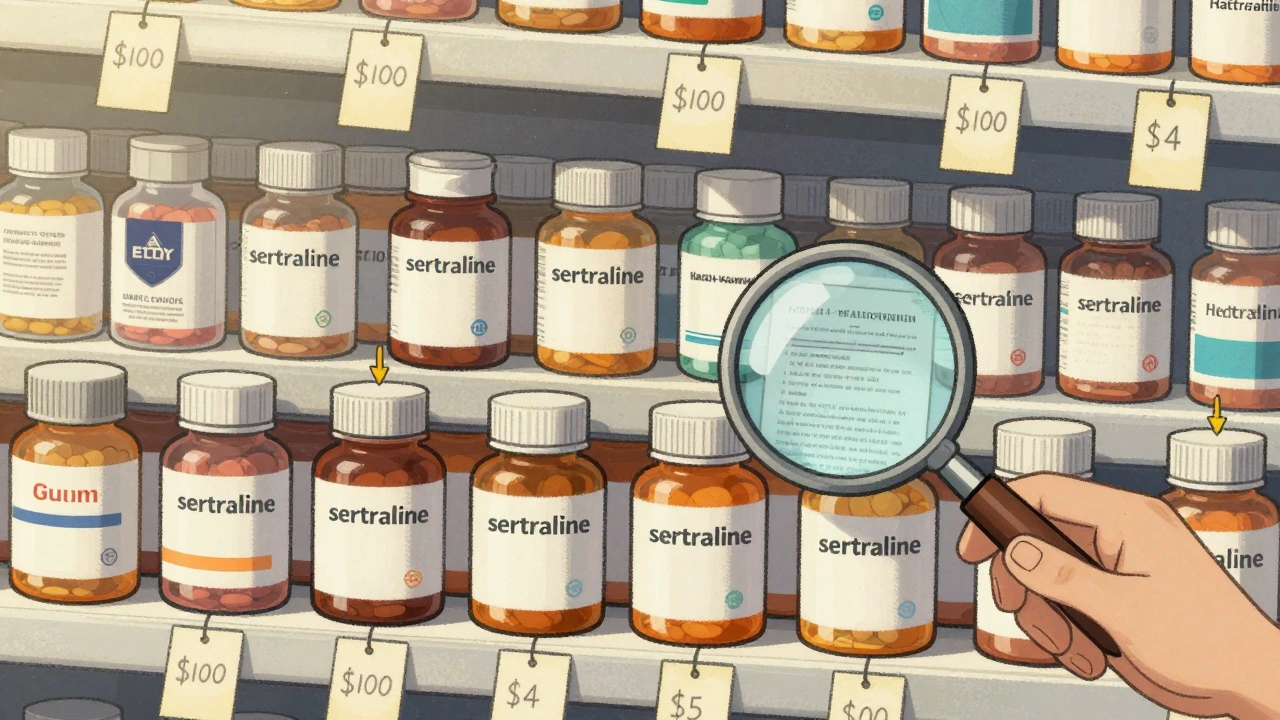

When you pick up a generic version of your prescription, you probably don’t think about how the price got so low. Maybe it’s $4 for a month’s supply of sertraline, or $10 for metformin. That’s not luck. It’s the result of a deliberate, decades-long system designed to let competition do the work - not government price setters.

Why Generics Don’t Need Price Caps

Generic drugs aren’t cheaper because the government said so. They’re cheap because the market forces them to be. Once a brand-name drug’s patent expires, dozens of companies can jump in and make the same pill. And they all want your business. That’s why prices drop fast - often by 75% within six months and 90% within two years when multiple generics are on the shelf.The U.S. system doesn’t set prices. It sets the rules for competition. The Hatch-Waxman Act of 1984 created the Abbreviated New Drug Application (ANDA) process. That means generic makers don’t have to repeat expensive clinical trials. They just prove their drug works the same as the brand. That cuts development costs from $2.6 billion to about $2-3 million. That’s the real engine of low prices.

Compare that to branded drugs. Ozempic, Wegovy, or insulin? Those still have patents. No competition. So the government steps in differently - negotiating prices directly under the Inflation Reduction Act. But for generics? The Department of Health and Human Services explicitly says they don’t need it. Why? Because competition already works.

The FDA’s Quiet Power

The Food and Drug Administration isn’t setting price limits. It’s speeding up approvals. That’s the real control mechanism.The Generic Drug User Fee Amendments (GDUFA), renewed in 2022 with $750 million in industry fees through 2027, pushed the FDA to cut approval times from 18 months to 10. In 2023 alone, the agency approved 1,083 generic drugs. That’s a 35% increase since 2017. More approvals mean more competitors. More competitors mean lower prices.

There’s a catch: complex generics. Drugs with tricky formulations - like inhalers, injectables, or extended-release pills - take longer. Only 38% of these met the 10-month target in 2023. To fix that, the FDA launched a special submission template in late 2023. Early results? Review times dropped 35% for pilot applications. It’s not about controlling price. It’s about removing roadblocks to competition.

You can even track this yourself. The FDA’s Generic Drug User Fee Public Dashboard, launched in October 2023, shows real-time status for every application. Transparency isn’t just good government - it’s good market function.

How the FTC Keeps the Market Fair

You might think generic markets are always competitive. But sometimes, brand-name companies try to block them.One common trick: "pay-for-delay." A brand-name maker pays a generic company to stay out of the market. That’s illegal. The Federal Trade Commission (FTC) has been chasing these deals for years. In 2023 alone, they challenged 37 of them. Each one blocked a cheaper drug from reaching shelves. The FTC estimates these actions could save consumers $3.5 billion a year.

The FTC also blocks mergers that would reduce competition. In January 2024, they stopped the proposed Teva-Sandoz merger because it would have cut the number of makers for 13 generic drugs from five to two. That’s not just corporate strategy - it’s consumer harm.

And it’s working. The FTC’s 2023 Pharmaceutical Competition Report concluded: "Generic drug markets generally function competitively without the need for price regulation." They don’t need price controls. They need watchdogs.

What Medicare Pays - And Why It’s Already Low

Medicare Part D doesn’t negotiate generic prices. It doesn’t have to. The system already has built-in discounts.According to the Medicare Payment Advisory Commission (MedPAC), Part D plans pay generic drugs an average of 15% below the Average Manufacturer Price (AMP). On top of that, they get rebates: 28% for preferred generics, 15% for others. That’s not government price setting. That’s private insurers leveraging volume to drive down costs.

And the numbers show it works. A 2024 KFF survey found 76% of Medicare beneficiaries pay $10 or less for their generic prescriptions. Compare that to just 28% for brand-name drugs. Generic users report 82% satisfaction with affordability. Brand users? Only 41%.

Even the Congressional Budget Office confirms this. Their analysis of H.R.3 - a bill that would have used international pricing for all drugs - found that applying it to generics would save Medicare only $2.1 billion a year. That’s 0.4% of total generic spending. Meanwhile, negotiating brand-name drugs? That could save $158 billion. The math is clear: focus on the big costs.

The Hidden Problem: Too Cheap to Make

There’s a dark side to low prices: some generics are so cheap, no one wants to make them.In May 2024, the American Society of Health-System Pharmacists (ASHP) found that 18% of hospital pharmacists had experienced shortages of critical generic drugs. Why? Manufacturers quit because the price fell below production cost. One example: a generic antibiotic used in ICUs. The price dropped to 12 cents a pill. The cost to make, package, and ship it? 15 cents.

This isn’t about greed. It’s about economics. If you can’t make money, you stop. And when a generic drug has only one or two makers, a single factory shutdown can cause a nationwide shortage.

That’s why the FDA’s 2024-2026 plan includes a focus on "authorized generics" - versions made by the original brand under license. These help keep competition alive when new entrants vanish. It’s not a price control. It’s a market stabilizer.

Why Other Countries Do It Differently

The U.S. isn’t alone in controlling drug prices. But it’s unique in how it handles generics.In Canada, the U.K., and Germany, governments set maximum prices for both brand and generic drugs. That’s why generic prices there are higher than in the U.S. - not because they’re less competitive, but because they’re capped.

The U.S. generic market has 14.7 manufacturers per drug on average. Europe? 8.2. Japan? 5.3. More players. More competition. Lower prices. That’s the American model: let the market run, but make sure the track is clear.

That’s also why the U.S. accounts for 42% of global generic drug volume but only 29% of value. We buy more, pay less.

What’s Next? More Competition, Not More Control

The next few years will focus on keeping the system working - not adding new price controls.The CMS Interoperability and Prior Authorization Proposed Rule, issued in April 2024, targets one hidden barrier: insurance companies forcing patients to jump through hoops to get generics. They’re proposing to ban unnecessary prior authorizations on generic drugs. That could save beneficiaries $420 million a year.

The FDA’s Complex Generic Drug Program is expanding. The FTC is still filing enforcement actions. And the GPhA’s Competitive Generic Therapy designation gives faster review to generics entering markets with too few competitors.

The Congressional Budget Office projects generic prices will keep falling - by 3.5% annually through 2030. Branded drugs? Only 0.8%. That’s not policy magic. That’s competition.

Government doesn’t need to set prices for generics. It just needs to clear the path, punish cheaters, and keep the door open for new makers. That’s how you get $4 pills that save lives - without a single price cap.

Lynn Steiner, December 3, 2025

This system is literally why I can afford my antidepressants. My mom couldn’t even get hers last year because of some stupid shortage. But yeah, I’ll take $4 sertraline over $400 any day. 🙏

Paul Keller, December 4, 2025

The elegance of this market-based approach cannot be overstated. By eliminating redundant regulatory burdens through the ANDA pathway while simultaneously enforcing antitrust measures, the United States has engineered a self-sustaining mechanism for pharmaceutical affordability that does not rely on the distortions inherent in centralized price controls. The data presented here is not merely anecdotal-it is statistically robust and empirically validated across multiple federal agencies.

Elizabeth Grace, December 6, 2025

OMG I just checked my last prescription and it was $3.50. I cried. Like, actually cried. My cousin in Canada pays $28 for the same thing and complains about "American capitalism." Bro, I’d pay $28 if it meant I didn’t have to wait 6 months for a damn pill to be made. 🤡

Joel Deang, December 6, 2025

so like the fda just says "go for it" and then boom cheaper drugs? that’s wild. i thought they were all about stopping everything. also why is it called "abbreviated"? like i abbreviate my texts but this is like a whole new system?? 🤔

Roger Leiton, December 7, 2025

This is actually one of the few things the U.S. does right. More competition = lower prices. Simple. The FDA’s dashboard is genius - I’ve been tracking my dad’s generic cholesterol med. It went from "under review" to approved in 4 months. That’s faster than my Netflix password reset. 🚀

Steve Enck, December 9, 2025

One must interrogate the underlying ontological assumption: that competition, as a metaphysical construct, inherently produces moral outcomes. The market does not care if a life is lost due to a 3-cent profit margin. The FDA's "transparency" is merely a performative gesture masking systemic failure. When the price of a life-saving antibiotic falls below the cost of its packaging, the system is not functioning - it is collapsing under the weight of its own ideological purity.

Jay Everett, December 10, 2025

Let me tell you something - this whole system is like a high-stakes poker game where the dealer is the FDA, the players are generic manufacturers, and the pot is your grandma’s insulin. The FTC? That’s the guy who catches the dealer cheating. And the fact that we’re saving billions by stopping pay-for-delay deals? That’s not policy. That’s justice with a spreadsheet. 💪

मनोज कुमार, December 11, 2025

US model works only because of scale. In India we have 50 manufacturers for same drug but still high prices due to logistics, taxes, corruption. You talk about competition but forget distribution. Also why not regulate? Simple solution. No need for 1083 approvals. Just cap price at 20% above cost. Done.

Laura Baur, December 11, 2025

It’s fascinating how Americans romanticize market forces while ignoring the human cost. When a manufacturer abandons a drug because it’s 12 cents a pill, who suffers? The elderly. The disabled. The uninsured. This isn’t capitalism - it’s a cruel lottery where your health depends on whether a corporation finds your medication profitable enough to produce. And now you’re celebrating a system that treats medicine like a commodity? Disgraceful.

Jack Dao, December 12, 2025

Of course you’d say that. You’re the kind of person who thinks "competition" solves everything - like how competition between Uber drivers made traffic worse. You ignore that when the market fails - and it does - you need someone to step in. The fact that we need authorized generics as a "stabilizer" proves your whole theory is broken. If it worked perfectly, why are we patching it?