When you take a medication like levothyroxine for hypothyroidism or phenytoin for epilepsy, your body doesn’t just need the right drug-it needs the exact same version every single time. Even tiny differences in how the drug is made can throw your blood levels off, leading to seizures, heart problems, or worse. That’s why narrow therapeutic index (NTI) drugs are handled differently by insurers-and why many patients and doctors are pushing back when insurers try to force them to switch to generics.

What Makes NTI Drugs So Different?

NTI drugs are a small but critical group of medications where the line between healing and harming is razor-thin. The FDA defines them as drugs where even small changes in blood concentration can cause therapeutic failure or toxicity. This isn’t theoretical. For someone on levothyroxine, switching from one generic brand to another-even if both are FDA-approved-can cause TSH levels to spike by 300%. That’s not a minor fluctuation. That’s a medical emergency waiting to happen. Common NTI drugs include:- Levothyroxine (for thyroid disorders)

- Phenytoin and carbamazepine (for epilepsy)

- Cyclosporine (for organ transplants)

- Warfarin (a blood thinner)

- Digoxin (for heart rhythm)

Why Do Insurers Even Try to Block Brand-Name NTI Drugs?

Most insurers operate under a simple rule: if a generic exists, use it. It saves money. And for most drugs, that’s fine. But for NTI drugs, that rule doesn’t just save money-it risks lives. The problem? Many insurance plans still treat NTI drugs like any other brand-name medication with a generic alternative. They require prior authorization before approving the brand version-even when the patient has been stable on it for years. This means doctors have to fill out forms, call insurance companies, wait days for a response, and sometimes get denied outright. According to a 2024 study in the Journal of Managed Care & Specialty Pharmacy, the average time to get approval for an NTI drug is 3.2 business days. For someone with epilepsy, that delay can mean a seizure. For someone on warfarin, it could mean a stroke. And it’s not just about delays. A Patients Rising survey found that 29% of patients taking NTI drugs reported an adverse health event directly tied to a prior authorization delay. That’s nearly one in three.How Are Insurers Actually Handling NTI Drugs?

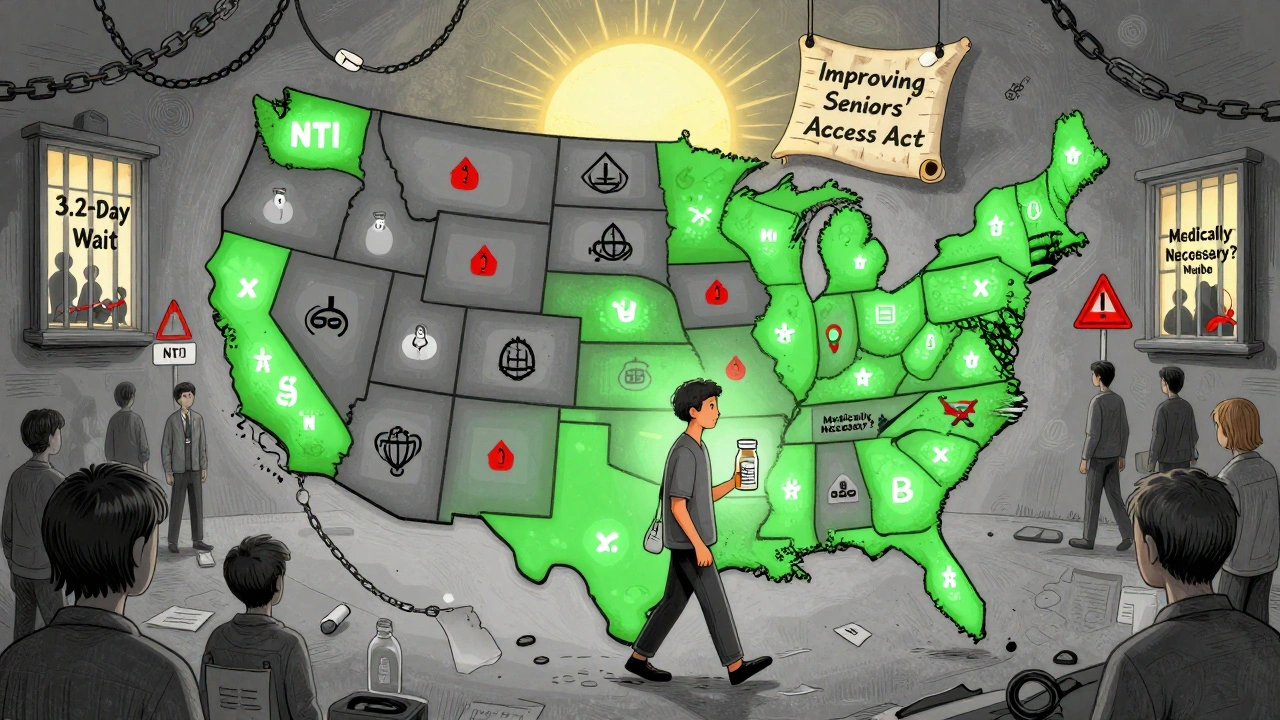

Here’s where it gets messy. There’s no national standard. Every insurer, every state Medicaid program, and every Medicare Part D plan does things differently. Some, like Health Net, explicitly say: “Brand drugs with a narrow therapeutic index may be listed on the Formulary at a higher tier and do not require prior approval.” That’s the right approach. If you’re stable on brand-name levothyroxine, you should stay on it-no paperwork needed. Others? Not so much. Medicaid programs in states like Mississippi and North Carolina still require prior authorization for brand-name NTI drugs unless the doctor writes “medically necessary” on the prescription. And even then, approval isn’t guaranteed. Medicare Part D plans call it a “coverage determination,” and while they’re required to respond faster than commercial insurers, many still drag their feet. A 2024 CAQH report found that NTI drug prior authorizations take 22% longer to process than standard ones-because insurers demand more clinical data, more lab results, more documentation. The result? A patchwork system where your access to a life-sustaining drug depends on where you live and which insurance company you’re stuck with.

What Do Doctors and Experts Say?

The medical community is united on this: prior authorization for NTI drugs is dangerous. The American Academy of Neurology released a position statement in February 2024 showing that 18.7% of epilepsy patients experienced preventable seizures because insurers forced them to switch generics. That’s not a statistic-it’s a failure of the system. Dr. Michael Rea of RxRevu put it bluntly: “Prior authorization for NTI drugs creates dangerous delays for patients who require immediate therapeutic consistency.” Even some managed care experts admit the system is flawed. Dr. Mark Linetsky of Prime Therapeutics says prior authorization saves plans $2.3 billion a year-but only if it’s done right. He argues that blanket restrictions on brand-name NTI drugs are the problem, not the concept of prior authorization itself. The real issue? Insurers are applying generic-switching rules to drugs that shouldn’t be switched at all.What’s Changing? New Laws and Real-World Fixes

Thankfully, things are starting to shift. In January 2025, California passed AB-1428, which bans insurers from requiring prior authorization for NTI drugs if the patient has been stable on the brand version. That’s huge. It’s not about cost-it’s about safety. Nineteen states now have laws that automatically approve an NTI drug request if the insurer doesn’t respond within a set time. Seven states had this in 2022. That’s a 171% increase in just two years. The federal government is catching up too. The Improving Seniors’ Timely Access to Care Act, passed by the House in April 2024, requires Medicare Advantage plans to give real-time electronic decisions on prior authorization requests-especially for NTI drugs. And insurers are starting to notice. A Jefferies Healthcare Policy Analysis predicts that by 2026, 75% of commercial health plans will eliminate prior authorization for established NTI drug categories. Why? Because the risks are too high, and the lawsuits are coming.

What Should You Do If You’re on an NTI Drug?

If you’re taking an NTI medication and your insurer denies your brand-name request, here’s what to do:- Ask your doctor to write “medically necessary” on the prescription-this triggers faster review in many states.

- Submit the prior authorization request electronically. Paper requests take 3-5 days. Online portals like NCTracks or Gainwell can cut that to 24-48 hours.

- Appeal immediately. The approval rate after initial denial is 82.4%, according to JMCP. Don’t give up after the first “no.”

- Document everything. Save copies of every denial, every call, every email. If you have an adverse event, this becomes evidence.

- Know your state’s laws. If your state requires automatic approval after 72 hours and they haven’t responded, call your state insurance commissioner’s office.

The Bigger Picture: Cost vs. Safety

Insurers say they’re trying to control costs. But when you look at the data, the savings are tiny compared to the risks. NTI drugs make up just 2.8% of specialty drug use but account for 5.2% of all prior authorization requests. That means insurers are spending a disproportionate amount of time and money fighting over a small group of drugs that can’t be safely substituted. Meanwhile, the cost of a single seizure hospitalization? Over $12,000. A stroke from a warfarin fluctuation? $50,000+. The real cost isn’t the brand-name pill-it’s the emergency room, the ICU, the lost workdays, the long-term disability. This isn’t about generics being bad. It’s about forcing a one-size-fits-all policy onto a group of drugs that demand precision.Final Thought: This Isn’t About Savings-It’s About Trust

Patients trust their doctors. They trust their medications. They trust the system to keep them safe. When an insurer blocks a brand-name NTI drug without clinical justification, that trust breaks. The system needs to change-not because brand-name drugs are expensive, but because for some medications, there is no safe alternative. The future of NTI drug access isn’t about more paperwork. It’s about recognizing that for some patients, stability isn’t a preference-it’s a necessity.Why can’t I just switch to a generic NTI drug to save money?

For most medications, switching to a generic is safe and saves money. But for NTI drugs like levothyroxine, phenytoin, or warfarin, even small differences in how the drug is made can cause your blood levels to swing dangerously. A 2024 study found that 18.7% of epilepsy patients had preventable seizures after being forced to switch generics. These drugs need consistency-not cost-cutting.

Does my insurance have to cover the brand-name version of my NTI drug?

Not automatically-but many states now require insurers to cover brand-name NTI drugs without prior authorization if you’ve been stable on them. California, for example, banned prior authorization for stable NTI drug patients as of January 2025. Check your state’s laws. If you’re on Medicaid, federal rules require coverage, but states can still impose barriers. If you’re denied, you have the right to appeal.

How long does prior authorization for NTI drugs usually take?

On average, it takes 3.2 business days to get approval for an NTI drug, according to a 2023 study. But if you submit electronically through your insurer’s portal, it can be as fast as 24 hours. Paper requests take longer. If your state requires a 72-hour response time and they haven’t answered, you can file a formal complaint with your state insurance department.

What if my prior authorization gets denied?

Don’t accept the first denial. The approval rate after appeal is 82.4%. Ask your doctor to write a detailed letter explaining why switching would be unsafe-include your lab results, seizure history, or TSH levels. Submit your appeal in writing and keep copies. Many insurers approve on the second try once they see the clinical evidence.

Are there any NTI drugs that are always covered without prior authorization?

Yes-some insurers, like Health Net, have policies that list certain NTI drugs as exempt from prior authorization. In states with new laws, like California, brand-name NTI drugs are automatically covered if the patient has been stable on them. The list includes levothyroxine, phenytoin, carbamazepine, and cyclosporine. Always check your plan’s formulary or call customer service to confirm your drug’s status.

Evelyn Pastrana, December 9, 2025

So let me get this straight-we’re risking people’s lives because some insurance execs think a 5-cent savings is a win? 🙄

Next they’ll make us switch toothpaste brands too. 'But both are minty!' Yeah, and both can kill you if you’re allergic to the filler.

Nikhil Pattni, December 9, 2025

Guys, I work in pharma logistics in India and let me tell you-this isn’t even the weirdest part. In the US, they have this obsession with 'brand consistency' but in places like Bangladesh or Nigeria, patients get generics with no monitoring at all and somehow survive. The real issue? The US healthcare system is a profit-first circus where patients are just data points. Also, did you know that in some countries, levothyroxine generics are made by the same factories as the brand? The difference is just the label and the price tag. Insurers are literally paying for a sticker.

And don’t even get me started on how the FDA approves generics based on bioequivalence ranges that are 80-125%-that’s a 45% swing! Imagine if your car’s engine could vary that much and still be 'safe.'

Elliot Barrett, December 10, 2025

This whole thing is a scam. If you can’t afford the brand, you shouldn’t be on the drug. Simple. People whine about 'stability' but they’re just addicted to the name on the bottle. Generic works. Get over it.

Andrea Beilstein, December 11, 2025

It’s funny how we treat medicine like a commodity when it’s the one thing that keeps us alive

We let algorithms decide who gets to live and who gets to hope

Insurance companies don’t care if your TSH spikes

They care if their quarterly report looks pretty

And we let them

Because we’re tired

Because we’re scared

Because we think someone else will fix it

But no one will

Until we stop being polite

Until we stop saying 'please'

And start saying 'this is murder'

And then we burn the whole system down

And rebuild it with hands not spreadsheets

Sabrina Thurn, December 13, 2025

From a clinical pharmacology standpoint, the bioequivalence thresholds for NTI drugs are fundamentally inadequate for clinical safety. The 80–125% AUC and Cmax range used by the FDA for generic approval is statistically valid for population-level data but fails catastrophically at the individual patient level for drugs like warfarin or phenytoin, where therapeutic windows are <5% of the dose. This is why the American College of Clinical Pharmacy recommends therapeutic drug monitoring (TDM) for all NTI switches-yet most insurers refuse to cover TDM unless the patient is already in crisis. It’s a reactive system pretending to be proactive. The solution isn’t just policy-it’s integrated pharmacogenomic data sharing between EHRs and PBMs to preempt dangerous substitutions. We have the tech. We just lack the will.

Richard Eite, December 13, 2025

California’s law is just socialism in a pill bottle. If you can’t afford your meds, get a better job. This country doesn’t owe you a brand-name prescription. #AmericaFirst

Tim Tinh, December 14, 2025

my buddy was on carbamazepine and his insurance made him switch to a generic and he had a seizure at work

lost his job

got a new one but now he’s on disability

the generic saved the insurer $12 a month

cost him $200k in medical bills and lost wages

so yeah… i think we’re doing something wrong here

also my doctor just told me to call the insurance and say 'my life depends on it' and they usually cave

it’s wild that we have to beg to not die

Ryan Brady, December 16, 2025

Typical liberal nonsense. Let the free market decide. If you need the brand, pay for it. Why should I subsidize your laziness?

Also, generics are just as good. You’re just scared of saving money.

Raja Herbal, December 18, 2025

Oh so now it’s a crisis because Americans can’t get their $12-a-pill brand? In my village in Bihar, people split pills with neighbors because they can’t afford even generics. You think your 'stability' is special? We’d kill for your problem.

But hey, at least your insurance has a formulary. We have no insurance. Just hope.

Lauren Dare, December 18, 2025

Let’s be clear: the term 'narrow therapeutic index' is a regulatory loophole exploited by pharma to maintain monopoly pricing. The FDA’s own data shows that 92% of NTI generics have bioequivalence within 5% of the brand. The real issue isn’t safety-it’s brand loyalty engineered by marketing. Patients aren’t being kept safe. They’re being manipulated. And insurers? They’re just the last to catch up to the scam.

Gilbert Lacasandile, December 18, 2025

I get what you’re saying about the delays and the risks… but I also think insurers aren’t all bad. They’re just trying to manage costs in a broken system. Maybe the answer isn’t to remove prior auth entirely, but to create a fast-track for NTI drugs? Like a green light if you’ve been stable for 6+ months? Just a thought.

Lola Bchoudi, December 19, 2025

From a pharmacy benefit management perspective, the 22% longer processing time for NTI prior auths isn’t due to complexity-it’s due to outdated systems. Most payers still use fax-based workflows for NTI requests, while non-NTI claims are auto-adjudicated. The fix? Mandate interoperable electronic prior authorization (ePA) standards for NTI drugs under CMS Rule 2024-02. We’ve had the tech since 2020. It’s a policy failure, not a clinical one. Also, the 82.4% appeal approval rate proves that initial denials are administrative, not clinical. They’re just gatekeeping.

Morgan Tait, December 20, 2025

Did you know that the same companies that make brand-name NTI drugs also own the generics? They just slap a different label on it. The FDA doesn’t inspect the factories differently. The 'brand' is a placebo. The real danger? The insurance companies are being controlled by the same Big Pharma lobby that convinced them generics are risky. It’s all one big pyramid scheme. They want you scared. They want you paying. And they want you to think it’s about safety… when it’s all about profit.

Also, the moon landing was faked. Just saying.

Katie Harrison, December 22, 2025

Canada doesn’t have this problem. We have universal coverage, and NTI drugs are automatically covered without prior authorization. No forms. No delays. No seizures from bureaucracy. We don’t treat medicine like a luxury item. Maybe we should stop pretending the U.S. system is the gold standard.

Sarah Gray, December 23, 2025

It’s amusing how laypeople conflate 'stability' with 'brand loyalty.' The clinical literature is unequivocal: bioequivalence studies for NTI drugs demonstrate no clinically significant difference between approved generics and brands when dosed appropriately. The real issue is physician inertia and patient anxiety-both of which are behavioral, not pharmacological. Your fear of generics is not a medical emergency. It’s a cognitive bias.